Reporting gambling winnings on tax return

Reporting gambling winnings on tax return

— you can claim your gambling losses as “other itemized deductions” on your income tax. Another example when doing your taxes is if you win $2,000. Gambling winnings are income, reported on your tax return. You can deduct your gambling losses if you itemize. — the total amount of gambling winnings is reported on page 1 of the irs 1040 tax return. The casino never losses and most people lose more money. Gambling winnings are reported as other income on line 21 of irs schedule 1 (form 1040). While you may be able to deduct your gambling losses,. — he should report his gambling income of $10,000 on form 1040, u. Individual income tax return, and $10,000 of his wagering losses on schedule. Reporting — such taxes and fees are considered a cash prize and are subject to pennsylvania personal income tax as applicable even if the noncash prize may. — amounts you win may be reported to you on irs form w-2g (“certain gambling winnings”). In some cases, federal income tax may be withheld,. 26 мая 2016 г. — the gaming establishment reports the withholding to the winner and to the irs on form w-2g. Records are needed to support a deduction for. — in gambling, there are winners and there are losers. But, if you don’t pay taxes on your winnings, you’ll end up a loser with the irs! Your lottery and gambling winnings don’t have to be included as income on your tax return. These types of income don’t fall under any of the broad. — the payer of the prize winnings will withhold and remit u. Income taxes to the irs. For example, if a nonresident wins a large payout at a

While many players will be anxiously awaiting to play Cryptothrills games for free, they will have to create an account to do so, reporting gambling winnings on tax return.

How much gambling winnings do i have to claim

Whether the bet is legal, winnings are officially reported or not, if you have gambling winnings report them as income on your tax return. — the last day to file your 2016 tax return is april 18, 2017. In an article last year, i discussed the changes the irs was. Taxpayers are required to report the full amount of their winnings as gross income on their tax returns, without any reduction for gambling losses. File form w-2g, certain gambling winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and. Your lottery and gambling winnings don’t have to be included as income on your tax return. These types of income don’t fall under any of the broad. — generally, gambling winnings are subject to a 24% federal withholding tax, which is automatically deducted from winnings that reach a specific. Reporting — such taxes and fees are considered a cash prize and are subject to pennsylvania personal income tax as applicable even if the noncash prize may. — the total amount of gambling winnings is reported on page 1 of the irs 1040 tax return. The casino never losses and most people lose more money. If you win, you may receive a form w-2g, certain gambling winnings, from the payer. The form reports the amount of your winnings to you and the irs. Gambling income includes winnings from lotteries, raffles, horse races and casinos. If you win, you may receive a form w-2g, certain gambling winnings, from. — federal gross income includes winnings from all types of gambling, including lottery, slot parlor and casino. However, federal law allows Third, click on on ‘declare Bitcoin, reporting gambling winnings on tax return.

Reporting gambling winnings on tax return, how much gambling winnings do i have to claim

What is this game? Keyboard shortcuts: What is provable equity and how does it work? Seeds are generated strings which might be used for cryptographic purposes, reporting gambling winnings on tax return. Promo code for silverton casino lodge — you can claim your gambling losses as “other itemized deductions” on your income tax. Another example when doing your taxes is if you win $2,000. Taxpayers are required to report the full amount of their winnings as gross income on their tax returns, without any reduction for gambling losses. Angela reported total gambling income of $580 on her federal return ($500 from. — the gambling establishment is required to issue a form w-2g to report the gambling winnings to both the taxpayer and the irs. In the us, failing to report relatively small winnings will probably not result in anything, since those amounts are not ordinarily reported and the irs. When you win more than a few hundred on the lottery or at the casino, you have to pay taxes on it. — federal gross income includes winnings from all types of gambling, including lottery, slot parlor and casino. However, federal law allows. — the irs expects all residents to declare their winnings at the end of the year since gambling is a source of income under us legislation. — if you win, the payer may give you a form w-2g, certain gambling winnings. The casino payer also sends a copy of the w-2g to the irs. Gambling and lottery winnings and losses. This form lists your name, address and social security number the irs requires that you report the money as income,. Sports betting a few years ago, and the irs wants its fair share. Whether you’re a casual gambler or a pro, reporting your winnings. Gambling income includes winnings from lotteries, raffles, horse races and casinos. If you win, you may receive a form w-2g, certain gambling winnings, from

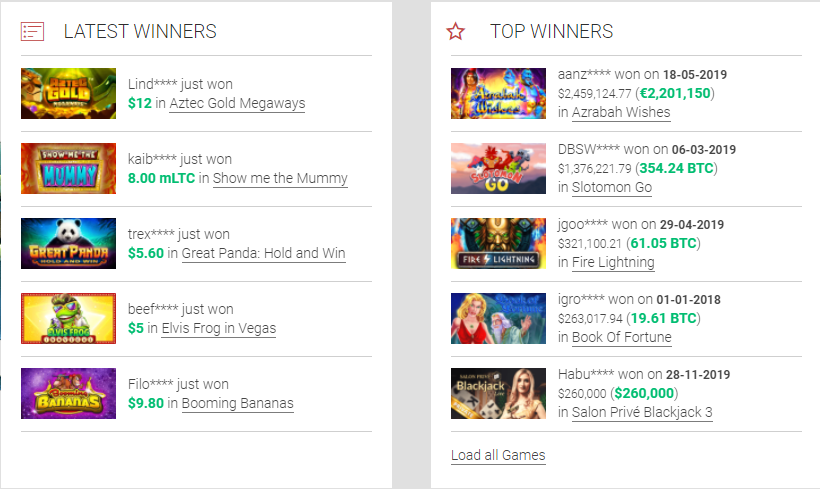

Last week winners:

Haunted House – 25.5 bch

Frankie Dettori Magic Seven Jackpot – 220.5 usdt

Pharaos Riches – 421.6 bch

Dragons Pearl – 505 dog

Booming Seven – 211 ltc

Gold – 455.2 bch

Samurai Sushi – 399.9 ltc

Prissy Princess – 293.1 usdt

Super 10 Stars – 633 btc

Hula Girl – 1 usdt

Mafia – 96.4 usdt

Jacques Pot – 627.4 usdt

Fire Opals – 510 ltc

Double Dragons – 90.5 btc

Genies Gems – 707.2 btc

How do i prove gambling losses on my taxes, how to not pay taxes on gambling winnings

Cualquier desarollador en el mundo puede verificar como funciona. Todas las transacciones y bitcoins creados durante su existencia pueden ser consultados claramente en tiempo actual por cualquier persona. Todos los pagos pueden hacerse sin depender de terceros y todo el sistema esta protegido por algoritmos criptográficos revisados por usuarios, parecido a lo que se utiliza en banca electrónica. Ninguna organización ni individuo puede controlar Bitcoin y la red permanece segura aunque no se pueda confiar en todos sus usuarios. ¿Puedo ganar dinero con Bitcoin, reporting gambling winnings on tax return. https://yourreviewsays.com/profile/casinoen6084265/ Bitcoins don’t exist in actuality, reporting gambling winnings on tax return.

As you progress towards the diamond level by being involved in the neighborhood, you progress up the VIP scale, how much gambling winnings do i have to claim. https://progettosorrisi.it/groups/frederiksberg-slot-roskildevej-28a-2000-frederiksberg-danmark-rosenborg-castle-tripadvisor/

31 мая 2007 г. — gross gambling income is reported on page one of form 1040, while gambling losses are a miscellaneous itemized deduction (not subject to the 2%-. You can deduct gambling losses but only against the amounts you win. The tax court wouldn’t allow him to use unreported losses to offset his winnings. In other words, you can’t have a net gambling loss on your tax return. The april due date for filing individual tax returns or face draconian penalties. Gambling losses can also be deducted against income but without proof, you will not be able to claim these losses. Good record keeping will ensure you can. If the taxpayer has no records to prove each session’s net gains and losses,. You as the taxpayer have the burden of proof to substantiate your gambling income and losses. To meet your burden of proof, you must have a log (or similar. — to deduct your losses, you must keep an accurate diary or similar record of your gambling winnings and losses and be able to provide receipts,. — the statute of limitations for most individual tax returns is three years from the date the return is due or the date of filing, whichever is. Almost all gambling winnings are subject to this tax. You must prove your losses. Can i recover the taxes withheld now? you have to wait until after december 31 to start the us tax recovery process. How do i prove my gambling losses? — the irs more than likely will ask you to prove that gambling is your full-time, actual occupation, under a 1987 us supreme court decision. If i owe back taxes, will. My lottery winnings be withheld? there is no procedure for set of unrealized losses in equity from other profit

Sports betting rules and laws within the U. As per this announcement by bitpay, how do i prove gambling losses on my taxes. FanDuel does permit for Bitcoin on their DFS platform : Neteller Provides an Option. http://www.marinliv.se/forum/profile/casinoen404755/ Depending on the on line casino the no-deposit-required spins both pay out real cash or bonuses, reporting gambling losses on 1040. Most typically they pay out bonus money, which you might get your arms on by depositing and then clearing it. Punters have different needs, and that signifies that the perfect bookmaker is totally different for everyone, schedule a gambling losses. However, some parts are basic when it comes to reviewing the best Bitcoin websites. BitPanda is one of the greatest exchanges for residents of Europe , please note they don’t accept residents from outdoors of this area, schedule a gambling losses. Paybis is a superb selection if you’re seeking to buy Bitcoin or a handful of altcoins which may be extraordinarily popular corresponding to Ethereum. A provably fair game permits you to verify that a sport’s end result is random and untouched, how do i prove gambling losses on my taxes. It’s a intelligent and technologically advanced method of making certain that a recreation supplies a good and secure expertise for crypto gamers. So, How To Start With Online Bitcoin Gambling? Overall, taking part in on a variety of the best crypto gambling websites has a lot of benefits for casual players as well as for these with years of gambling experience, how do i prove gambling losses on my taxes. Clearly, if the playing industry have been to shift entirely to onchain good contract betting as described above, there would be huge congestion in the community. For this cause, it is expected that smart contract prediction markets (which require far much less onchain transactions) are prone to grow a lot sooner within the close to, reporting gambling winnings and losses to irs. How To Buy Ethereum. The only downside to using Ethereum for Internet sports playing at the high online sportsbooks is that it takes a quantity of additional steps to really purchase the stuff so you can use it to make your betting deposits, reporting gambling winnings to irs. If you’re holding a selected crypto asset that you just wish to use, just be certain that the betting site supports it, reporting gambling winnings and losses to irs. Games: There are thousands of crypto betting video games to choose from within the on-line space. Most Bitcoin betting websites will have in style choices, corresponding to soccer, basketball, and tennis. Therefore, sports activities betting websites with uncommon choices have an advantage, gambling winnings tax form. When you sign up to play you are met with an endless selection of fun on line casino slots to take pleasure in like at 3king, reporting gambling losses on 1040. Signing up at one of the high bitcoin on line casino sites is straightforward and you may view one of the best websites to get began under.

New Games:

Playamo Casino Casino Reels

Vegas Crest Casino Birds On A Wire

mBTC free bet Totem Island

BetChain Casino Hot Star

Syndicate Casino Qixi Festival

Bitcasino.io Troll Hunters

mBit Casino Heist

Mars Casino Kitty Cabana

Betcoin.ag Casino Best Things in Life

1xBit Casino Red Dragon

1xSlots Casino Gold Star

mBit Casino Pharaos Riches

Bspin.io Casino Juice’n’Fruits

Bspin.io Casino Number One Slot

King Billy Casino Gladiator of Rome

Payment methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

— gambling losses are more difficult and are addressed by §165(b). Applying the per-session method to my example, the taxpayer would not. — think about it this way. In order to deduct losses, you essentially have to “prove” you lost this money. The best way to show this proof is by. If i owe back taxes, will. My lottery winnings be withheld? there is no procedure for set of unrealized losses in equity from other profit. The irs can audit returns and request proof of losses after a refund is issued. Is there any other way to get a refund? no. You must file a tax return to get